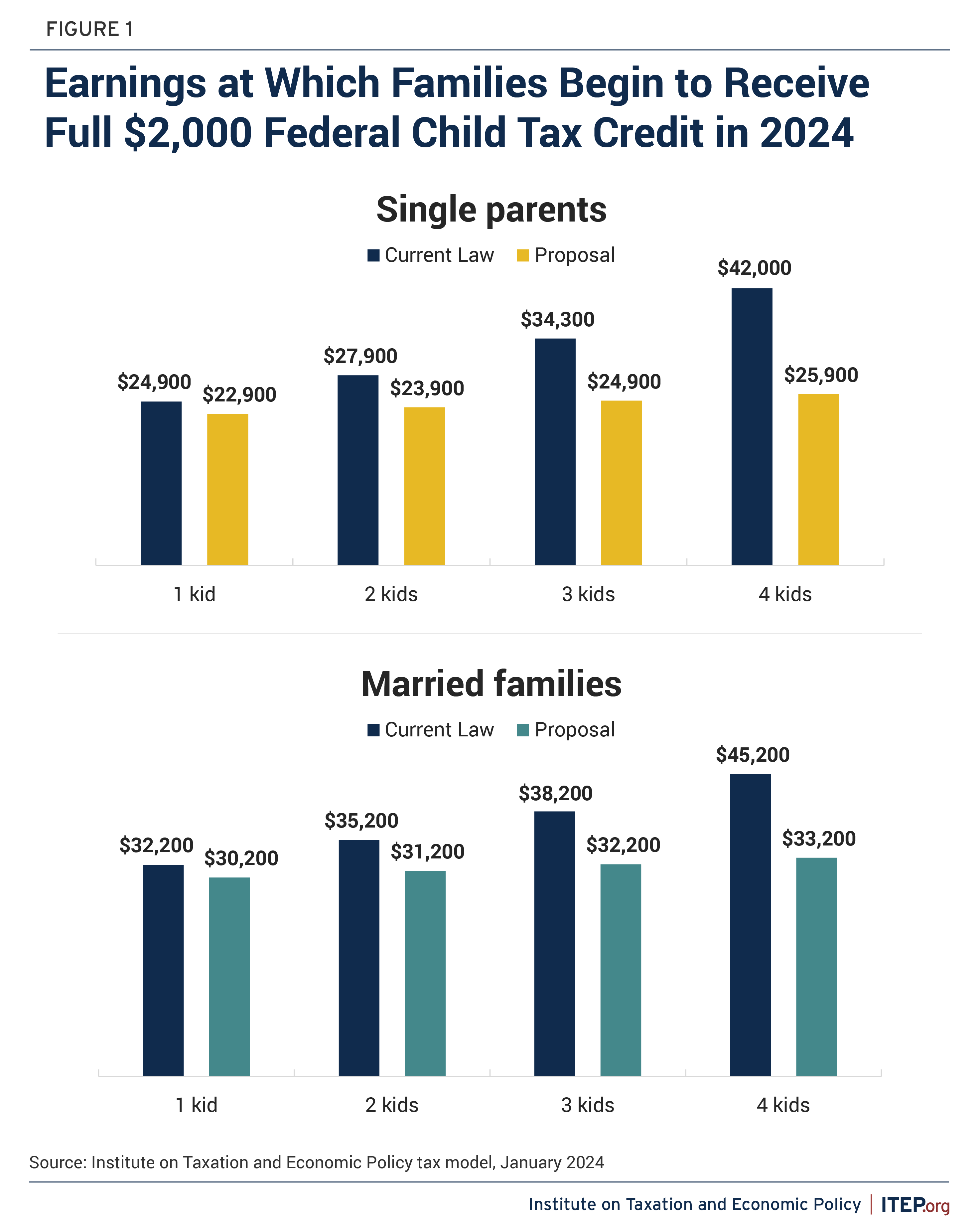

Child Tax Credit 2024 Monthly Payments Income – Here’s how a proposed change in the rules for the child tax credit impact tax refunds and the upcoming tax season. . A new tax bill aims to increase access to the child tax credit for lower-earning families — but it’s much less generous than it was in 2021. .

Child Tax Credit 2024 Monthly Payments Income

Source : itep.org

Child Tax Credit 2024 Income Limits: What is the income limits for

Source : www.marca.com

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com

Proposed Tax Deal Would Help Millions of Kids with Child Tax

Source : itep.org

$300/Month Child Tax Credit Increase in United States, How to know

Source : www.wbhrb.in

New Expanded Child Tax Credit Proposed: Who Would Benefit? | Money

Source : money.com

Policy Basics: The Earned Income Tax Credit | Center on Budget and

Source : www.cbpp.org

Child Tax Credit 2024 Monthly Payments Income States are Boosting Economic Security with Child Tax Credits in : An expansion of the Child Tax the credit payable in monthly installments of up to $300. President Biden had pushed for the credits to be continued but Congress failed to act on an extension and . For 2023 tax year, the maximum tax credit available per child is $2,000 for each child under 17 under Dec. 31, 2023, CNET reported. If you are eligible, it could reduce how much you owe in taxes but, .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)